If you have the best credit card Philippines, using it responsibly right now can help you save from needing to dig yourself out of personal debt later. Additionally, it may conserve you from the issues that have a bad credit history.

Carrying a Balance Will Set You Back

Bank cards are actually high-curiosity loans in disguise. The firms loan you money, plus they get it all back again and even more by charging interest – a fee for borrowing the amount of money – and other charges. Credit card costs may include:

- Finance costs on the unpaid part of your bill, which may be as much as twenty five percent each month

- Cash-advance charges with also higher interest rates

- Annual and late-payment fees

If you pay back the whole amount you borrowed from – or balance – every month, you may avoid large finance charges. If you don’t pay whatever you owe on a monthly basis, you could finish up having to spend your cash to pay interest fees and charges rather than your actual balance.

Your Credit Score Matters

Businesses record your credit cards payment background in something called a credit file. After college, you’ll want an excellent credit history so that you can rent a flat, buy an automobile or take out financing. Many employers may also check your credit score before they hire you. Problems with bank cards, such as for example late or missed obligations, stay in your credit file for seven years.

Tips for Handling Credit

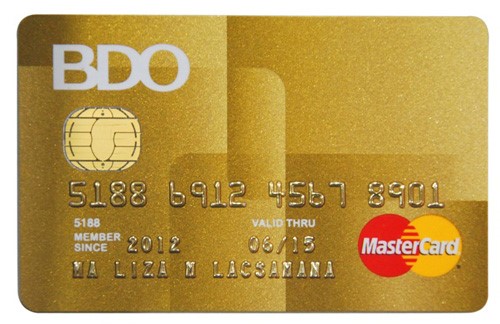

If a debit card is in your name, you are accountable for paying the bill. Make use of your bdo shopmore credit card wisely and adhere to a few rules, and you will build a great credit history:

- Read all application components carefully, especially the small print. What happens following the introductory interest expires? What goes on to your interest if you neglect to make a payment?

- Use a debit cards (or cash) rather than a credit card when you can. That method, you can’t spend a lot more than you actually have.

- Save your credit cards for emergencies, when possible.

- Use credit only when you’re sure you can repay your debt.

- Avoid buying issues you don’t need.

- Pay bills promptly to keep costs down. Pay the entire balance every month when you can.

Government law limits how credit card issuers can work with people beneath the age of 21. If you don’t can show which you have more than enough income to make monthly premiums, you’ll need a grown-up cosigner – that’s, a grown-up who promises to consider responsibility for the mortgage – to obtain a credit cards. This law is intended to protect teenagers from making errors and overusing credit. But it’s still your decision to control your credit wisely.